VA Disability Rates 2021 – Veteran military customers who turned ill, injured, or wounded throughout their services might be entitled and suitable to receive VA disability compensation– a tax-free benefit payment offered through the Department of Veterans Affairs. For a much more comprehensive read about the most recently upgraded VA Disability Compensation Tax, begin to see the write-up under.

What’s VA Disability Rate?

VA disability pay out is a tax-free monetary reward offered for military veterans on monthly foundation owing to their service-related disability. The purpose would be to compensate them for your reduced existence top quality as well as civilian employability.

The compensation might be assigned for post-service disabilities too if they are regarded as to become secondary or connected to during the service and connected to the service circumstances that may arise later on in everyday life.

The VA Disability Compensation Tax is set and adjusted by the Department of Veterans Affairs based on Cost-of-Living-Adjustments (COLA). You might use tables of compensation benefits rate, which also presented in this post to compute your monthly payment in accordance for your private circumstances.

How can VA Disability Work?

The unwell, hurt, or health-affected military members because of to military serving might be suitable for month-to-month benefit payments this kind of as VA Disability Compensation Tax. However, the compensation is not granted automatically by The Department of Veterans Affairs. It makes use of considerations of one’s medical background, healthcare data, claimed situation particulars, and other factors that could relate in your health critiques.

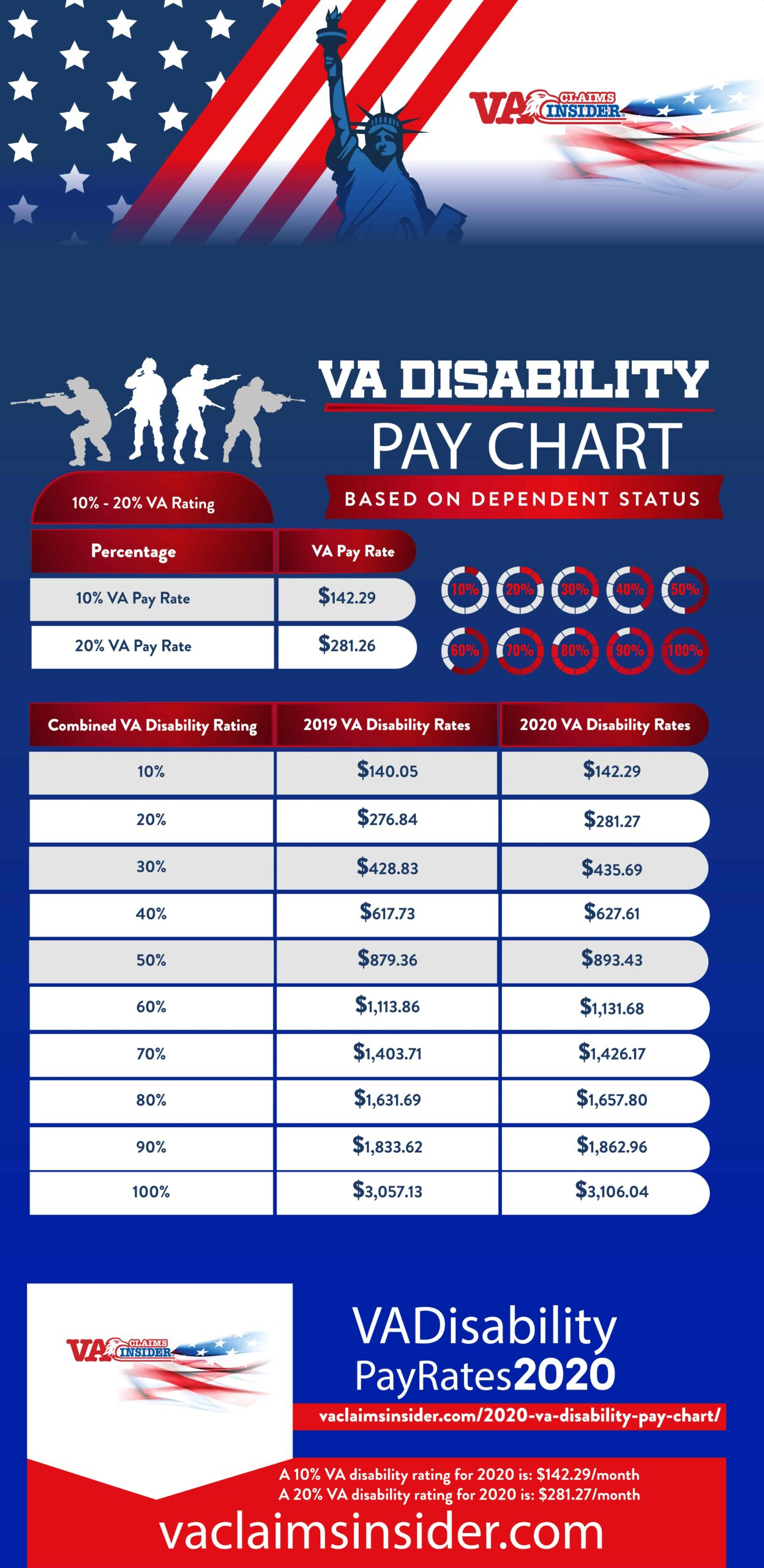

VA Disability Rates 2021

The rate of VA Disability Compensation is adjusted every year. VA disability rates 2021 are deemed as effective commencing from December 1, 2020. You should be obtaining recognize regarding the elevated amount by January 2021, in case you are a receiver of VA disability pay out.

As in the year 2021, the rate was improved as much as 1.3% from the previous year, which can be decidedly reduce than the prior-year increment of 1.6%.

To check the VA Disability Compensation Tax, you might appear at the subsequent tables that offered the rate information for various situations:

10 – 20% Disability

| Percentage | Rate |

| 10% | $144.14 |

| 20% | $284.93 |

30 – 60% Disability (Without Children)

| Dependent Status | 30% | 40% | 50% | 60% |

| Veteran Alone | $441.35 | $635.77 | $905.04 | $1,146.39 |

| Veteran with Spouse Only | $493.35 | $705.77 | $992.04 | $1,251.39 |

| Veteran with Spouse and One Parent | $535.35 | $761.77 | $1,062.04 | $1,335.39 |

| Veteran with Spouse and Two Parents | $577.35 | $817.77 | $1,132.04 | $1,419.39 |

| Veteran with One Parent | $483.35 | $691.77 | $975.04 | $1,230.39 |

| Veteran with Two Parents | $525.35 | $747.77 | $1,045.04 | $1,314.39 |

| Additional for A/A spouse | $48.00 | $64.00 | $81.00 | $96.00 |

70 – 100% Disability (Without Children)

| Dependent Status | 70% | 80% | 90% | 100% |

| Veteran Alone | $1,444.71 | $1,679.35 | $1,887.18 | $3,146.42 |

| Veteran with Spouse Only | $1,566.71 | $1,819.35 | $2,044.18 | $3,321.85 |

| Veteran with Spouse and One Parent | $1,664.71 | $1,931.35 | $2,170.18 | $3,462.64 |

| Veteran with Spouse and Two Parents | $1,762.71 | $2,043.45 | $2,296.18 | $3,603.43 |

| Veteran with One Parent | $1,542.71 | $1,791.35 | $2,013.18 | $3,245.02 |

| Veteran with Two Parents | $1,640.71 | $1,903.35 | $2,139.18 | $3,428.00 |

| Additional for A/A spouse | $113.00 | $129.00 | $145.00 | $160.89 |

30 – 60% Disability (With Children)

| Dependent Status | 30% | 40% | 50% | 60% |

| Veteran with Spouse and Child | $532.35 | $756.77 | $1,056.04 | $1,328.39 |

| Veteran with Child Only | $476.35 | $681.77 | $963.04 | $1,216.39 |

| Veteran with Spouse, One Parent and Child | $574.35 | $812.77 | $1,126.04 | $1,412.39 |

| Veteran with Spouse, Two Parents and Child | $616.35 | $868.77 | $1,196.04 | $1,496.39 |

| Veteran with One Parent and Child | $518.35 | $737.77 | $1,033.04 | $1,300.39 |

| Veteran with Two Parents and Child | $560.35 | $793.77 | $1,103.04 | $1,384.39 |

| Add for Each Additional Child Under Age 18 | $26.00 | $34.00 | $43.00 | $52.00 |

| Each Additional Schoolchild Over Age 18 | $84.00 | $112.00 | $140.00 | $168.00 |

| Additional for A/A spouse | $48.00 | $64.00 | $81.00 | $96.00 |

70 – 100% Disability (With Children)

| Dependent Status | 70% | 80% | 90% | 100% |

| Veteran with Spouse and Child | $1,656.71 | $1,922.35 | $2,160.18 | $3,450.32 |

| Veteran with Child Only | $1,526.71 | $1,772.35 | $1,992.18 | $3,263.74 |

| Veteran with Spouse, One Parent and Child | $1,754.71 | $2,034.35 | $2,286.18 | $3,591.11 |

| Veteran with Spouse, Two Parents and Child | $1,852.71 | $2,146.35 | $2,412.18 | $3,731.90 |

| Veteran with One Parent and Child | $1,624.71 | $1,884.35 | $2,118.18 | $3,,404.53 |

| Veteran with Two Parents and Child | $1,722.71 | $1,996.35 | $2,244.18 | $3,545.32 |

| Add for Each Additional Child Under Age 18 | $61.00 | $69.00 | $78.00 | $87.17 |

| Each Additional Schoolchild Over Age 18 | $197.00 | $225.00 | $254.00 | $281.57 |

| Additional for A/A spouse | $113.00 | $129.00 | $145.00 | $160.89 |

For more details, you can check here: https://www.va.gov/disability/compensation-rates/veteran-rates/ & https://www.va.gov/health-care/eligibility/.